Are you new to investing and was wondering: what is a custodian bank? Many new investors get lost in the terminology and the way investment accounts are set up. A custodian bank is a financial institution that plays a key role in handling, safeguarding, and protecting your money and investments.

A custodian bank, the Fort Knox for your money

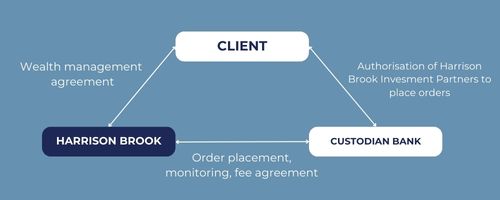

When you invest your money, you will normally work with a financial advisor to help decide how, and what, investments to choose. However, once you make your choice, your money, securities and investments should be placed with a custodian bank.

The top priority of a custodian is to hold their customers’ stocks, bonds, or other assets for safekeeping to prevent them from being stolen or lost. Assets are usually held in electronic form at one of the custodian’s premises, a sub-custodian facility, or an outside depository.

Additional custodian services

Custodians also typically settle trades, invest cash balances as directed, process corporate actions (stock splits, dividend and interest payments, etc.), and price securities positions. They also provide recordkeeping and reporting services such as account administration, tax support, and foreign exchange management.

Custodian banks vs. traditional banks

The difference between custodian banks and traditional banks is their primary roles.

- Traditional banks: Manage day-to-day deposits and withdrawals, and extend loans. Bank customers should be familiar with such activities and the products.

- Custodian banks: Custodians are responsible for, above all, the safekeeping of financial assets, as well as properly clearing and settling the various regulatory and accounting procedures that are often far too complex or time consuming for investors. On the other hand, they don’t offer services provided by traditional banks such as loans or checking accounts.

How to choose a custodian bank

- Reputation

- Financial stability

- Security

- Investment Options

- Regulatory compliance

- Fees and charges

- Service quality

- Advanced services

World’s biggest custodian banks

Since they are responsible for the safety of assets and securities worth hundreds of millions or even billions of dollars, custodians tend to be large and reputable firms.

- Bank of New York Mellon

- JPMorgan Chase

- Citigroup

- Bank of China (China)

- UBS (Switzerland)

- Deutsche Bank (Germany)

- Barclays (England)

- BNP Paribas (France)

What happens if you live overseas?

Overseas investors have the advantage of two options for managing their investments. They can choose a custodian in their home country, or work with one in their new country of residence.

The final choice will depend on a myriad of factors – security, tax implications, etc. – which is why it is important to carefully research the custodians that are available to you. For this reason, it is best to work with a Harrison Brook cross-border financial advisor and seek professional advice tailored to your financial situation.

The Custodian Challenge for US Expats

US expats often face a frustrating dilemma as many American custodians are reluctant to accept clients residing overseas, while local custodians may shy away due to the complexities of FATCA compliance . This leaves expats with limited options.

At Harrison Brook, we’ve recognized this challenge and developed strong partnerships with reputable custodians in both the US and the EU. Our goal is to provide US expats with reliable, respected, and viable investment solutions that meet their unique needs.

Peace of mind with a Harrison Brook cross-border financial advisor

If you are starting to invest your money or planning for your retirement, especially with the added restrictions of living overseas, we recommend contacting a cross-border advisor at Harrison Brook to optimize your investments and avoid costly mistakes. Proactive planning with the right team will ensure you reach your financial goals and continued financial security. Harrison Brook is here to assist you in managing your financial assets, so don’t hesitate to book a meeting with us.